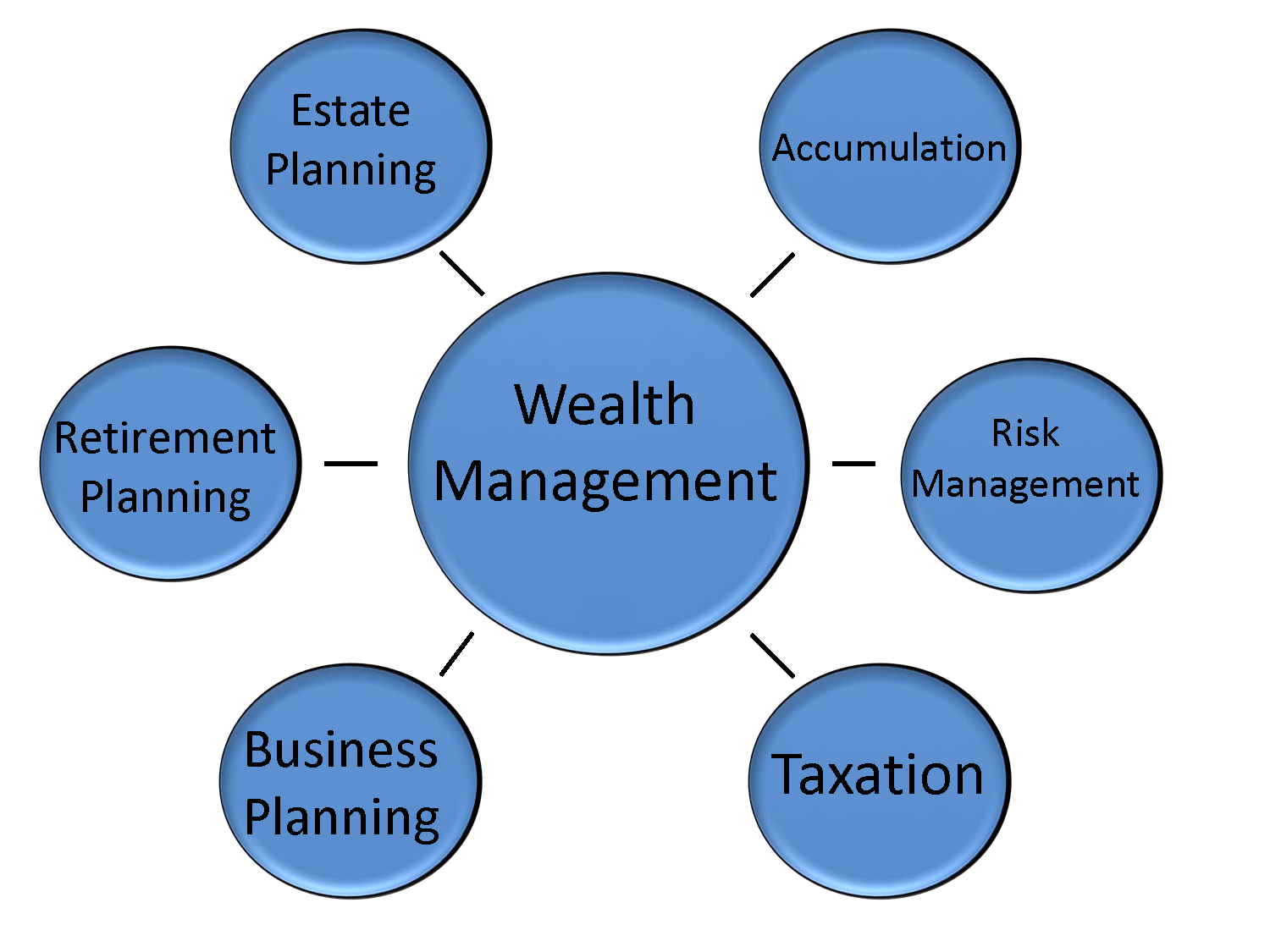

| Accumulation |

Means more that amassing wealth—it involves earning, managing, and consuming money. Accumulation planning is putting together a portfolio of appropriate investments that will pursue your financial target, whether investing for retirement, college, or another goal. |

| Business Planning |

Focuses on issues specific to business owners and shareholders. Some topics to consider when working with a business owner are compensation, group benefits, and how to access the value of the business at retirement, disability, or sale. |

| Estate Planning |

| Is the process of creating a master plan for the management of property during life and the distribution of property at death. Estate planning can give you more control over your assets during life, provide care when you are disabled, and allow for the transfer of wealth to your beneficiaries at the lowest possible cost. |

|

| Retirement Planning |

| Is the process of evaluating a client's current financial standing and creating an accumulation strategy that will help to ensure a desired financial security. Once financial security is achieved, the focus shifts to distribution planning and other issues to be considered as life stage goals. |

|

| Risk Management/Insurance |

| Is intended to minimize financial and other losses potentially associated with risks to your assets, health, or business. Focus is on disability, life insurance, health insurance, and long-term care insurance. |

|

| Taxation |

| Tax planning considers the implications of individual, investment, and business decisions, with the goal of minimizing tax liability. |

|

| Wealth Management |

| Wealth management, in particular, is the practice of accumulating, protecting, and transferring wealth. |

|